This web page is under construction

What is the best charity to give your money to in order to help the poor of this world? How do you decide, or where can you go to find advice?

To illustrate, as an example, a method of discovery and appraisal in order to answer these questions, the Association ARK AID has chosen Compassion International Inc. and the group of charities associated with Compassion; this because of their representative character being similar to other large Christian charities. As well, Compassion has been relatively transparent and lucid about it's work, finances, and identity. In comparison, an organization such as World Vision, with 9 international offices, 92 country offices, 37 of which are separate legal entities, some as unconsolidated affiliates, 3.4 million sponsored children, etc., with $ 2.96 billion expenditure (in 2019), is more complex to investigate and use as an illustration of charity appraisal.

But the transparency of Compassion has changed in 2019 which also has consequences for appraisals. This because Compassion had decided to adopt the status of church. Read more about "When A Church is Not A Church".

To illustrate, as an example, a method of discovery and appraisal in order to answer these questions, the Association ARK AID has chosen Compassion International Inc. and the group of charities associated with Compassion; this because of their representative character being similar to other large Christian charities. As well, Compassion has been relatively transparent and lucid about it's work, finances, and identity. In comparison, an organization such as World Vision, with 9 international offices, 92 country offices, 37 of which are separate legal entities, some as unconsolidated affiliates, 3.4 million sponsored children, etc., with $ 2.96 billion expenditure (in 2019), is more complex to investigate and use as an illustration of charity appraisal.

But the transparency of Compassion has changed in 2019 which also has consequences for appraisals. This because Compassion had decided to adopt the status of church. Read more about "When A Church is Not A Church".

But what is ARK AID ?

The Association - ARK AID is a Christian gift giving facilitator and nonprofit watchdog.

AAA benchmarks Christian charities involved in the alleviation of poverty and injustice among the most vulnerable and the abject poor.

ARK AID is conducting research in the science of the comparative analysis of the predictive power of metrics used in output and outcomes predictions of 'Christian' nonprofits involved in poverty alleviation. This activity is done with the corollary of establishing a succinct algorithm that assigns a relative value to a nonprofit. This research and value determination is done with a view to benchmarking nonprofits for the benefit of benefactors who want to let their mind meet their heart, and generate a maximum impact, when giving to help the marginalized of this world.

The Association - ARK AID is a Christian gift giving facilitator and nonprofit watchdog.

AAA benchmarks Christian charities involved in the alleviation of poverty and injustice among the most vulnerable and the abject poor.

ARK AID is conducting research in the science of the comparative analysis of the predictive power of metrics used in output and outcomes predictions of 'Christian' nonprofits involved in poverty alleviation. This activity is done with the corollary of establishing a succinct algorithm that assigns a relative value to a nonprofit. This research and value determination is done with a view to benchmarking nonprofits for the benefit of benefactors who want to let their mind meet their heart, and generate a maximum impact, when giving to help the marginalized of this world.

The results of this investigation and appraisal are represented on a benchmark scale given as a percentage, or a number out of 100. This relative value of a nonprofit is displayed by way of data visualization on a web page using a multiple range slider to show the various metrics used for appraisal. The resulting value is then transposed into the common 5 star value representation system. The slider is adaptable for personal preference. In this way comparisons can be made between various nonprofits.

|

For more information about ARK AID, go to:

AAA.ngo (general reference page) AAA.ong (about AAA in Romance languages) AAA.gold (interactive appraisal) AAA.how (AAA methodology: this page) AAA.charity (AAA charity spreadsheet) a-AAA.com (AAA appraisal) a-AAA.net (AAA awareness) a-AAA.org (AAA assistance) |

1. ARK AID only rates organizations that have some claim to being Christian.

2. ARK AID only rates organizations that claim to help the extremely poor. 3. ARK AID only rates very large 'support-charities' and the 'output-charities' when that information is made available. 4. ARK AID only rates that single aspect of an organization that has to do with the effectiveness of help for the extremely poor (Multipurpose charities that also have as their purpose aid for the extremely poor invariably receive lower rating scores which is not a judgment about the charity as a whole). |

The stakeholders served by ARK AID are exclusively those whose desire it is to

- make a maximum impact

- by providing 'direct' aid

- for the extremely poor

- in a Christian context.

These restrictions are on account of the fact that ARK AID holds that a one-size-fits-all evaluation approach is not sustainable.

So, why another rating organization? What's wrong with what's out there already?

First of all, what is out there?

Not much. The accreditation agencies that for a fee give a stamp of approval do not rate. They often do not even make public the rejection of those nonprofits that apply for a stamp of approval and do not meet the requirements. And as to organizations that rank or rate charities, they are very scarce. Many countries do not even have a single organization of this kind. Rating organizations that work internationally are nonexistent; this, while many nonprofits work internationally, having offices in many countries, and transfer grants back and forth among themselves. A value determination of accreditation agencies and a 'rating' of rating organizations is explained below.

First of all, what is out there?

Not much. The accreditation agencies that for a fee give a stamp of approval do not rate. They often do not even make public the rejection of those nonprofits that apply for a stamp of approval and do not meet the requirements. And as to organizations that rank or rate charities, they are very scarce. Many countries do not even have a single organization of this kind. Rating organizations that work internationally are nonexistent; this, while many nonprofits work internationally, having offices in many countries, and transfer grants back and forth among themselves. A value determination of accreditation agencies and a 'rating' of rating organizations is explained below.

When appraisal is made of Compassion Int., or any other charity, it is of importance to recognize several basic principels:

Aid appraisal is not a neutral science;

but is founded on predetermined values, presuppositions, axioms, and basic assumptions. Everyone has these. It is necessary to be transparent about these departure points.

When making appraisals, ARK AID has regard to the following basic assumptions:

A basic assumption:

"The heart is deceitful above all things, and desperately wicked" (Jeremiah 17:9). ARK AID keeps this in mind when appraising charities. ARK AID does not assume that all aid organizations are functioning properly until the opposite is revealed by way of the media or otherwise. Nonprofits must demonstrate that they are doing good.

1. Charity appraisal is not a neutral science

Philanthropy is all about voluntarily doing good; about giving to make an impact. But what is good? How are maximum outputs and impact to be measured? All impact measurements are based on value judgments about what good is. But whose values? For a Christian the measure of truth and goodness is God Himself, His Word, and the pattern of His love for man (philos-anthropos: Titus 3:4). One then, for example, takes into account eternal values and the impact of eternal destiny next to temporal social improvements when assessing a charity. For missionary work, to give another example, this means that an assessment of output is as much based on faithfulness as it is on success measured in numbers (of converts). For others with different values, these metrics of eternal values and conversion would be rated quite differently, even having a negative value. For many goodness is defined in a quantitative, rather than a qualitative, sense, as for example when one speaks of 'good money', which means a lot of money, which, it is assumed, is good. There ought not to be the presumption of neutral ground when making appraisals.

2. Because appraisal implies the making of value judgments, contrasting charities, without assessing basic values, invariably implies apples and oranges comparisons.

It is common practice when rating charities, whether by those doing comparative ratings or those accreditation agencies giving a stamp of approval, that comparisons are restricted to that which charities have in common. Umbrellas and toasters have a financial aspect in common. They both cost money. But comparing the two on this basis would be recognized as absurd. Giving 10 dollars to the 35 billion dollar endowment fund of Harvard University or giving it to a mother whose child is dying because of diarrhea can be compared. Both have a financial component: fund raising costs, overhead costs, assets, money flow transparency, salaries, etc. But the more fundamental component is value-based; whether it is better to give to the one, or to the other, to both, or to neither.

3. Apples with apples value comparisons are only viable when one has respect to charity output task (projects) comparisons and not to charity organizational comparisons as such.

An example: charity 'A' and charity 'B' both claim that 90% of gifts that they receive are for project costs. 10% is for fund raising and administration. 'A' and 'B' both have the same partner 'C' to whom they give grants. How do they compare?

Charity 'A' has three projects: (1) education (about 'A' and what 'C' is doing), and (2) advocacy (about the need to give to 'A'), and (3) grants to 'C'. 'A' gives 40% of gifts to 'C', 20% is used for education, and 30% is used for advocacy.

Charity 'B', on the other hand, has only one project and that is giving grants to 'C'. 'B' gives 90% of gifts to 'C'.

So, how can 'A' be compared to 'B' without making a value judgment about the impact and social good of education and advocacy? They can't. As the nature and tasks of charities become more diffuse, output and outcomes measurements, comparisons, and appraisal becomes more problematic. An example: just 4 charities, each with only 10 characteristics which need to be measured, would result in 10,000 variables, as is the case for a 4 number pin code. Task comparisons are vital. Charity organizational comparisons are only relevant to the degree that they have a bearing on the realization of the task.

4. In assessing aid given toward poverty alleviation, it is imperative to restrict task measurements to a single task group in order to be meaningful.

The implication is that a value judgment is not provided by ARK AID about other charity tasks such as education of the more well to do, advocacy, culture, environment, etc. The consequence is that comparisons are not made between charities involved in poverty alleviation and others involved in remotely related or other non-related tasks. In charity appraisal the maxim that one-size-fits-all is not applicable. The stakeholders served by ARK AID are, for this reason, exclusively those whose desire it is to make a maximum impact by providing 'direct' aid for the extremely poor.

5. In assessing aid given toward poverty alleviation, it is desirable to restrict task measurements to 'direct' aid in order to be meaningful.

In an indirect way poverty can be reduced by giving towards education, good governance, advocacy, environment, as well as numerous other causes, sometimes even more effectively then by 'direct' aid. Research in the area of effective altruism and comparative impact measurement of differing tasks is of tremendous importance but extends beyond the scope of ARK AID appraisal activity. These 'indirect' aid benefits can at will be added in the interactive charity evaluator as an extra metric of evaluation: see AAA.gold

6. 'Direct aid' is to be understood differently than 'earmarked aid'.

Appeals to give to a charity are often accompanied with a promise that a gift will be earmarked for a certain project such as adoption of a child mentioned by name, a cow for a poor person, mosquito nets, etc. Appeals for CEO salaries, fundraising costs, etc. are never made. Unless there is transparency and provision has been made to show how there are separate money-flows indicating how solicitation for administration and fund-raising costs is made in isolation of 'project costs', then earmarked aid is not evaluated in isolation of total aid revenue.

but is founded on predetermined values, presuppositions, axioms, and basic assumptions. Everyone has these. It is necessary to be transparent about these departure points.

When making appraisals, ARK AID has regard to the following basic assumptions:

A basic assumption:

"The heart is deceitful above all things, and desperately wicked" (Jeremiah 17:9). ARK AID keeps this in mind when appraising charities. ARK AID does not assume that all aid organizations are functioning properly until the opposite is revealed by way of the media or otherwise. Nonprofits must demonstrate that they are doing good.

1. Charity appraisal is not a neutral science

Philanthropy is all about voluntarily doing good; about giving to make an impact. But what is good? How are maximum outputs and impact to be measured? All impact measurements are based on value judgments about what good is. But whose values? For a Christian the measure of truth and goodness is God Himself, His Word, and the pattern of His love for man (philos-anthropos: Titus 3:4). One then, for example, takes into account eternal values and the impact of eternal destiny next to temporal social improvements when assessing a charity. For missionary work, to give another example, this means that an assessment of output is as much based on faithfulness as it is on success measured in numbers (of converts). For others with different values, these metrics of eternal values and conversion would be rated quite differently, even having a negative value. For many goodness is defined in a quantitative, rather than a qualitative, sense, as for example when one speaks of 'good money', which means a lot of money, which, it is assumed, is good. There ought not to be the presumption of neutral ground when making appraisals.

2. Because appraisal implies the making of value judgments, contrasting charities, without assessing basic values, invariably implies apples and oranges comparisons.

It is common practice when rating charities, whether by those doing comparative ratings or those accreditation agencies giving a stamp of approval, that comparisons are restricted to that which charities have in common. Umbrellas and toasters have a financial aspect in common. They both cost money. But comparing the two on this basis would be recognized as absurd. Giving 10 dollars to the 35 billion dollar endowment fund of Harvard University or giving it to a mother whose child is dying because of diarrhea can be compared. Both have a financial component: fund raising costs, overhead costs, assets, money flow transparency, salaries, etc. But the more fundamental component is value-based; whether it is better to give to the one, or to the other, to both, or to neither.

3. Apples with apples value comparisons are only viable when one has respect to charity output task (projects) comparisons and not to charity organizational comparisons as such.

An example: charity 'A' and charity 'B' both claim that 90% of gifts that they receive are for project costs. 10% is for fund raising and administration. 'A' and 'B' both have the same partner 'C' to whom they give grants. How do they compare?

Charity 'A' has three projects: (1) education (about 'A' and what 'C' is doing), and (2) advocacy (about the need to give to 'A'), and (3) grants to 'C'. 'A' gives 40% of gifts to 'C', 20% is used for education, and 30% is used for advocacy.

Charity 'B', on the other hand, has only one project and that is giving grants to 'C'. 'B' gives 90% of gifts to 'C'.

So, how can 'A' be compared to 'B' without making a value judgment about the impact and social good of education and advocacy? They can't. As the nature and tasks of charities become more diffuse, output and outcomes measurements, comparisons, and appraisal becomes more problematic. An example: just 4 charities, each with only 10 characteristics which need to be measured, would result in 10,000 variables, as is the case for a 4 number pin code. Task comparisons are vital. Charity organizational comparisons are only relevant to the degree that they have a bearing on the realization of the task.

4. In assessing aid given toward poverty alleviation, it is imperative to restrict task measurements to a single task group in order to be meaningful.

The implication is that a value judgment is not provided by ARK AID about other charity tasks such as education of the more well to do, advocacy, culture, environment, etc. The consequence is that comparisons are not made between charities involved in poverty alleviation and others involved in remotely related or other non-related tasks. In charity appraisal the maxim that one-size-fits-all is not applicable. The stakeholders served by ARK AID are, for this reason, exclusively those whose desire it is to make a maximum impact by providing 'direct' aid for the extremely poor.

5. In assessing aid given toward poverty alleviation, it is desirable to restrict task measurements to 'direct' aid in order to be meaningful.

In an indirect way poverty can be reduced by giving towards education, good governance, advocacy, environment, as well as numerous other causes, sometimes even more effectively then by 'direct' aid. Research in the area of effective altruism and comparative impact measurement of differing tasks is of tremendous importance but extends beyond the scope of ARK AID appraisal activity. These 'indirect' aid benefits can at will be added in the interactive charity evaluator as an extra metric of evaluation: see AAA.gold

6. 'Direct aid' is to be understood differently than 'earmarked aid'.

Appeals to give to a charity are often accompanied with a promise that a gift will be earmarked for a certain project such as adoption of a child mentioned by name, a cow for a poor person, mosquito nets, etc. Appeals for CEO salaries, fundraising costs, etc. are never made. Unless there is transparency and provision has been made to show how there are separate money-flows indicating how solicitation for administration and fund-raising costs is made in isolation of 'project costs', then earmarked aid is not evaluated in isolation of total aid revenue.

First of all, it is important that we look at the right Charity. Charities often choose look-alike names to profit from this fact. With hundreds of charities with names including the word "Compassion", we first check to see if the correct one is in view.

The reference year 2019 is used in this example of charity appraisal.

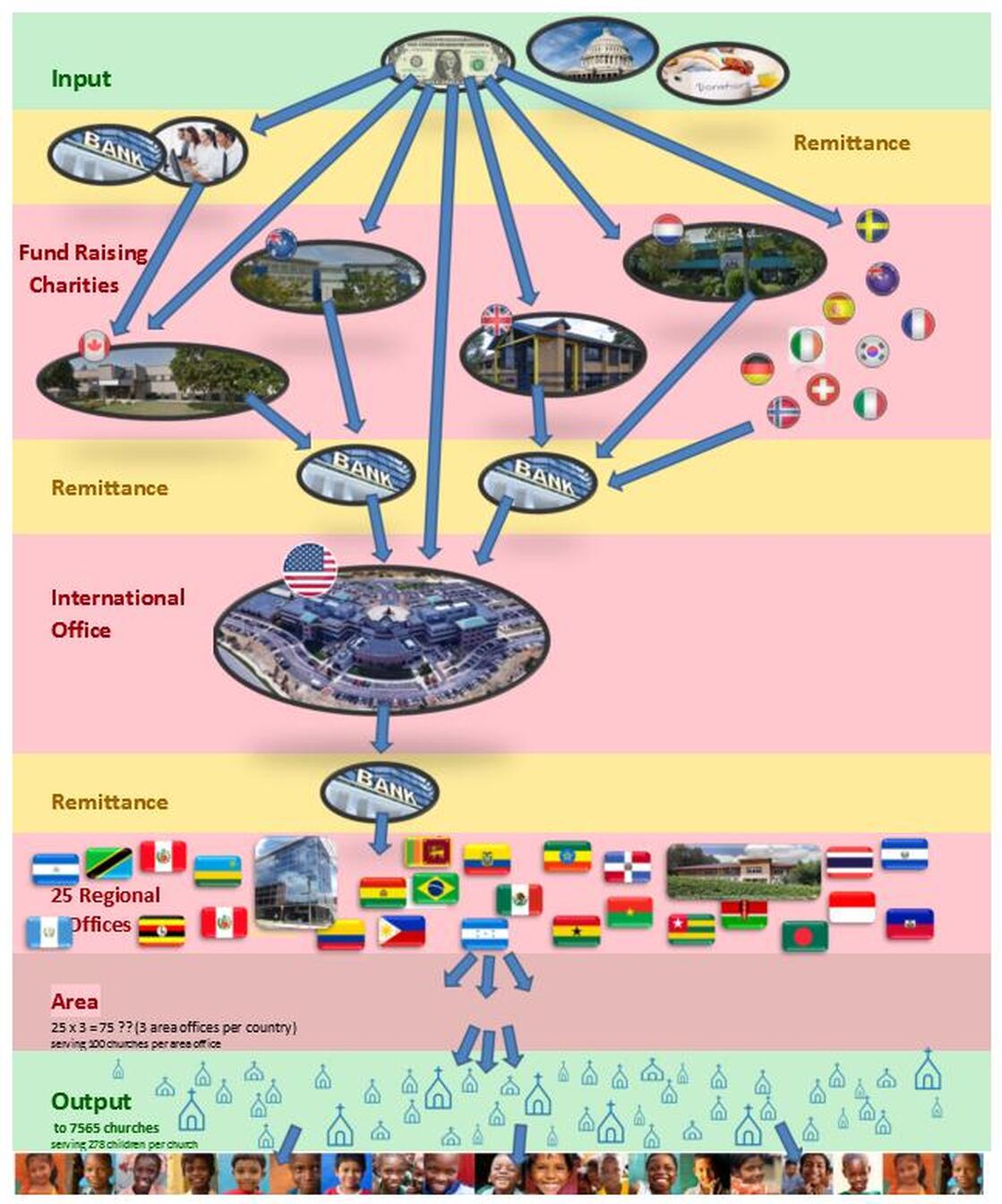

But what are we looking at when evaluating Compassion? To answer that question, it is important to realize that all large charities are made up of a charity chain.

Compassion explains it in this way:

Compassion explains it in this way:

"the delivery of help to children in beneficiary countries is coordinated and implemented centrally through Compassion International.

Fundraising partner countries transfer funds raised to Compassion International which are then used to support

programs in the 25 front-line field countries. Grants paid to Compassion International cover the grants to the

front-line church partners and running the field country and area offices, as well as program costs at Compassion

International." (p. 37 of 2018/2019 Annual Report of Compassion UK)

Fundraising partner countries transfer funds raised to Compassion International which are then used to support

programs in the 25 front-line field countries. Grants paid to Compassion International cover the grants to the

front-line church partners and running the field country and area offices, as well as program costs at Compassion

International." (p. 37 of 2018/2019 Annual Report of Compassion UK)

|

The chain involves: [input] the gift---remittance charities and banks---14 country fundraising charities---banks---the international office---banks---25 field country offices---area offices---front-line church partners--- [output] Each link in the chain deducts costs from the grants received from the former link, before passing grants on to the next link in the chain. |

|

It is evident that appraisal of a single link in the chain is of little relevance when one is concerned about how much of the input ends up as output; as well as the values and identity of the last link in the chain; and how much of your gift is used for 'freeing children from poverty in Jesus' name'. And yet, of the few organizations rating charities, and of the accreditation agencies giving a seal of approval to charities, there are none that concern themselves with this important fact that charities do not work in isolation but must be viewed as a conglomerate, aggregate, consortium, or corporate body.

|

The following diagram illustrates the Compassion chain (explanation below)

The Compassion Chain (in 2019)

1. The input to compassion, as it is with other charities, can originate from three sources: a) money or securities donations, b) grants from governments or other nonprofits, c) gifts in kind.

2. Remittance costs: these may be bank costs, call center costs, platform costs of transfer agencies, etc.

3. Fund raising charities costs: this involves 14 country charities; the offices of 4 of these countries is displayed.

4. Remittance costs: bank costs, international currency exchange costs.

5. Coordination and fund raising costs (International office).

6. Remittance costs: bank costs, international currency exchange costs

7. Country office costs: this involves offices in 25 countries. The Kenya office and the Columbia office, as examples, are displayed.

8. Area office costs. We estimate that there are about 3 area offices, in each of the 25 countries, each serving about 100 churches.

9. Partner costs: the 7565 churches, each partner serving on average 278 children.

10. Output: the aid.

We look at the money-flow from input to output, in which, for ARK AID, the most significant question is: what percentage of the input ends up as output? We also look at the identity and integrity of a charity, as well as the recipient of the gift, and the probable results and impact. No other rating agency or accreditation agency uses this methodology. How others approach evaluations, and why they are insufficient, is explained below.

1. The input to compassion, as it is with other charities, can originate from three sources: a) money or securities donations, b) grants from governments or other nonprofits, c) gifts in kind.

2. Remittance costs: these may be bank costs, call center costs, platform costs of transfer agencies, etc.

3. Fund raising charities costs: this involves 14 country charities; the offices of 4 of these countries is displayed.

4. Remittance costs: bank costs, international currency exchange costs.

5. Coordination and fund raising costs (International office).

6. Remittance costs: bank costs, international currency exchange costs

7. Country office costs: this involves offices in 25 countries. The Kenya office and the Columbia office, as examples, are displayed.

8. Area office costs. We estimate that there are about 3 area offices, in each of the 25 countries, each serving about 100 churches.

9. Partner costs: the 7565 churches, each partner serving on average 278 children.

10. Output: the aid.

We look at the money-flow from input to output, in which, for ARK AID, the most significant question is: what percentage of the input ends up as output? We also look at the identity and integrity of a charity, as well as the recipient of the gift, and the probable results and impact. No other rating agency or accreditation agency uses this methodology. How others approach evaluations, and why they are insufficient, is explained below.

ARK AID holds that each link in the charity chain has both a retrospective and prospective responsibility to the other charities in the chain for the right use of donations. For example, a charity that hires a call-center (charity) which deducts 75% of donations for their costs, has that retrospective responsibility which not only reduces the eventual output but also reflects on the wisdom of that charity to use this call center. It also reflects on the integrity of a charity if they do not make this transparent. Or a charity that gives grants to the next link in chain which pays exorbitant salaries to its workers, reflect a prospective responsibility about the wisdom of that charity.

We are made to ask the basic question: What are the main metrics of investigation and measurement, and what relative importance should be given to each metric? What are the most important questions to ask when giving to a charity? ARK AID uses 4 metrics.

The Metrics of Appraisal

Each charity is given 4 segments (metrics) of evaluation, each of which are graded with a percentage value out of 100 according to the ARK AID selected standards. These grades are shown in the bottom row of the appraisal table (see below).

Each metric on the slider also shows the calculated charity value points in the second row.

0-50 points are calculated for segment 1 concerning 'Revenue' [50% of the slider = the relative importance]; and

0-20 points for segment 2 concerning the 'Religious' [20%]; and

0-15 points for segment 3 concerning the 'Recipients' [15%]; and

0-15 points for segment 4 concerning 'Results' [15%].

The points are calculated on the basis of (1) the percentage value assessment and (2) the relative importance ascribed to the metric

The total amount of points in the middle row of the 4 segments are then transposed to the 5 star value system and shown below the slider.

Each charity is given 4 segments (metrics) of evaluation, each of which are graded with a percentage value out of 100 according to the ARK AID selected standards. These grades are shown in the bottom row of the appraisal table (see below).

Each metric on the slider also shows the calculated charity value points in the second row.

0-50 points are calculated for segment 1 concerning 'Revenue' [50% of the slider = the relative importance]; and

0-20 points for segment 2 concerning the 'Religious' [20%]; and

0-15 points for segment 3 concerning the 'Recipients' [15%]; and

0-15 points for segment 4 concerning 'Results' [15%].

The points are calculated on the basis of (1) the percentage value assessment and (2) the relative importance ascribed to the metric

The total amount of points in the middle row of the 4 segments are then transposed to the 5 star value system and shown below the slider.

Adaptation of the evaluation is possible in 3 ways:

1. It is possible that the slider be used to increase or decrease the size (the relative significance) of one or more segments (metrics). When this is done, the remaining segments are decreased or increased proportionally as to size which in turn influences the number of points allotted to each segment. When the total amount of points change by this action, then also the value ascribed to the 5 stars change. This action allows for viewer input by the evaluation of nonprofits. It allows for personal preference as to the relative importance of the various segments of evaluation (the channels) by changing the percentage of their influence.

2. It is also possible to add segments (metrics) and give a personal points value to those segments in the case that one is of the opinion that another area of evaluation should be added to the 4 that ARK AID uses.

3. The percentage evaluation given by ARK AID of each metric can be changed to what you think it should be.

This personal preference as to choice of metrics, and the relative value of the metrics, will be sustained if comparisons are made with multiple charities out of the list. And again, in each case, the new total points value of the charity will be ascribed to the 5 stars visualization.

1. It is possible that the slider be used to increase or decrease the size (the relative significance) of one or more segments (metrics). When this is done, the remaining segments are decreased or increased proportionally as to size which in turn influences the number of points allotted to each segment. When the total amount of points change by this action, then also the value ascribed to the 5 stars change. This action allows for viewer input by the evaluation of nonprofits. It allows for personal preference as to the relative importance of the various segments of evaluation (the channels) by changing the percentage of their influence.

2. It is also possible to add segments (metrics) and give a personal points value to those segments in the case that one is of the opinion that another area of evaluation should be added to the 4 that ARK AID uses.

3. The percentage evaluation given by ARK AID of each metric can be changed to what you think it should be.

This personal preference as to choice of metrics, and the relative value of the metrics, will be sustained if comparisons are made with multiple charities out of the list. And again, in each case, the new total points value of the charity will be ascribed to the 5 stars visualization.

also see: AAA.gold

Explanation of the 4 segments of evaluation:

R1 (Revenue) is a measurement of the effectiveness of the throughput of a 'gift', between the giving and the 'spending'. This accounts, in the case of ARK AID appraisal, for a maximum of 50 points of the total evaluation of a charity. For each percentage point of gift transfer efficiency, one point out of a hundred (or, 1% out of a maximum of 100%) is allotted to the total evaluation. An example: $100,000 in given to a call-center charity which passes a portion of that amount on to a 'fund-raising-charity' ; grants of a portion of this amount are given to the 'mother-charity'; then the mother re-grants a portion to a 'partner-charity' which itself also has overhead costs. The partner-charity 'spends' $10,000 for the 'project'. This is 10% of the total amount donated. This gives an evaluation grade of 10% which is equal to 5 points in the case of a relative importance of the revenue metric being 50%

R2 (Religious) is an appraisal of integrity (max. 10 points) and identity (max. 10 points). An evaluation grade of 100% would give a total of 20 evaluation points. This applies foremost to the 'output charity' and secondarily to the 'control charity', 'fund raising charity' and other organizations in the 'charity-chain'. Questions are asked as to the truth factor of claims about results, costs, fund raising methodology, donation anchors, investment policy, etc. Inquiry is also made about the meaning of the professed 'Christian' identity, of explicit or implicit values, a statement of faith, etc.

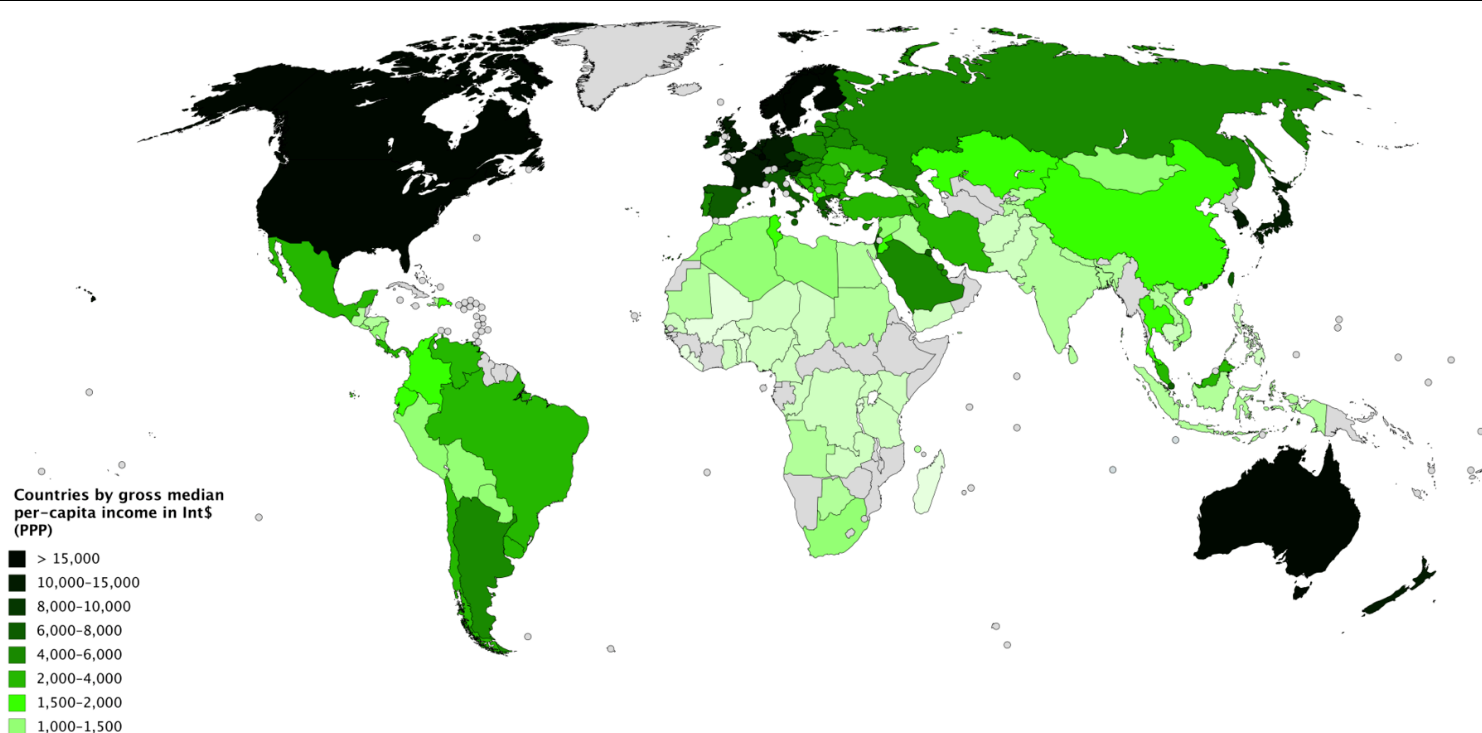

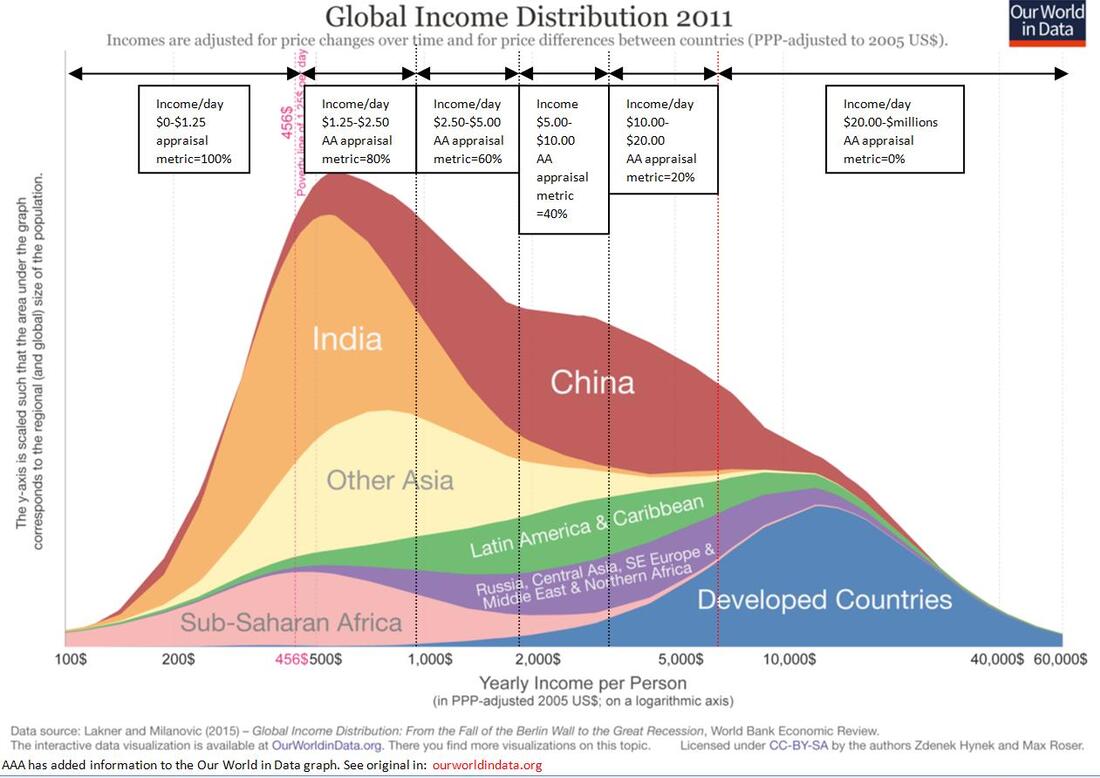

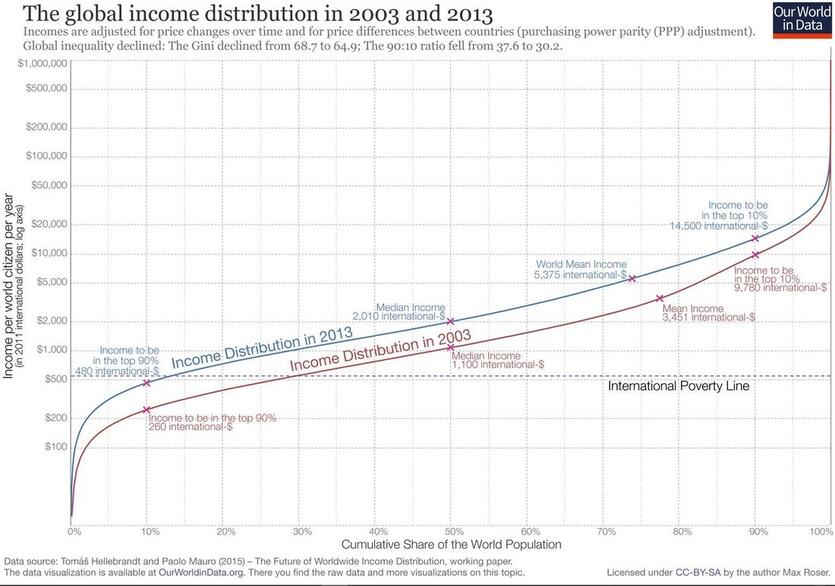

R3 (Recipient) is an assessment of the poverty level of the benefactors of the gift. Maximums of 15 points (a grade of 100%) go to the level $0-$1.25/ day average population income; 80% for level $1.25-$2.50; 60% for level $2.50-$5.00; 40% for level $5.00-$10.00; 20% for level $10.00-$20.00; and 0% for levels of income above $20.00/day. Measurements are according to purchasing power parity. The measurement is country dependent, excepting for those cases in which the recipient group is clearly identified.

R4 (Results) takes a look at those things that are indicative of the level of accomplishment that a 'output charity' would probably realize. This includes levels of professionalism (5 points), specialization (5 points), and concentration of project locations (5 points), etc. Results measurements are only indicative; we hold that a quantification of results as such, and more so of outcomes and impact, although desirable, is at its best only partially attainable. It may seem to be insufficient to only give a maximum of 15 points for results measurements. After all, this is what giving is all about. But we hold that the variables of Revenue, Religious, and Recipient are themselves indicators of Results. Less Revenue (throughput of the gift), as an example, is indicative of the fact that Results would also be less.

Results are for a large part influenced by the nature of the aid provided. Adoption schemes, water purification and availability, health and education, mosquito nets, microfinance loans, agricultural aid, etc., etc., all differ as to impact by poverty alleviation, but are not taken into account by ARK AID appraisal. It is made possible to include this, according to personal preference, by adding an impact metric to the 'interactive charity evaluator' or by expanding the relative importance of the Results metric and changing the evaluation given by ARK AID to that metric.

Below is an expanded explanation of the 4 ARK AID metrics with a comparative analysis of the methodology used by other agencies.

1. Revenue

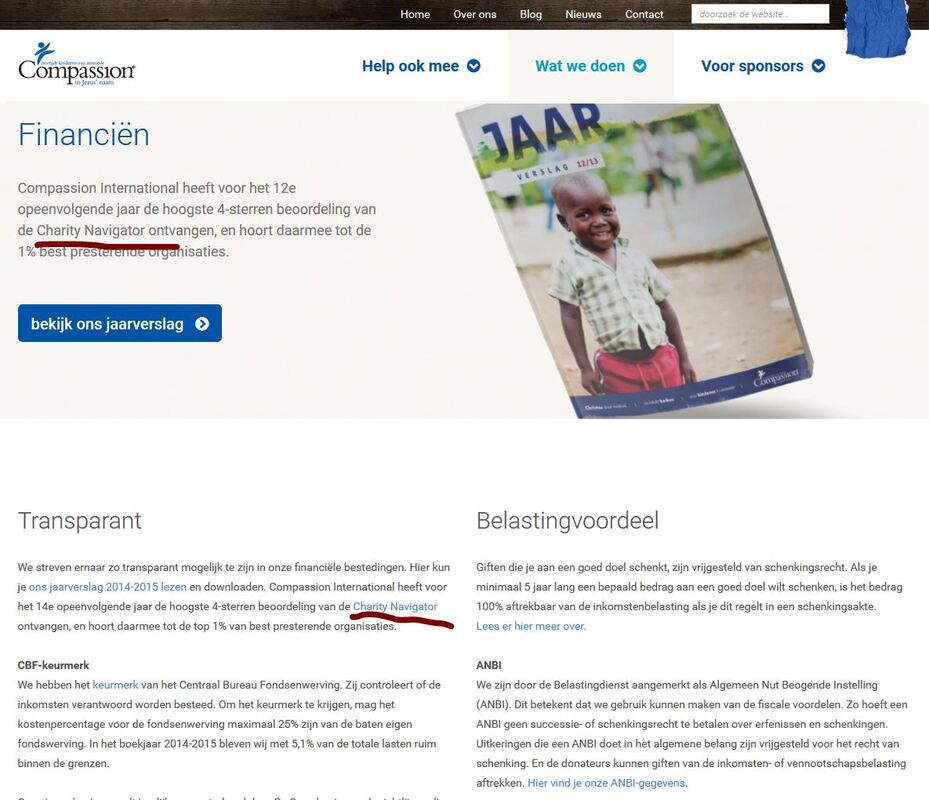

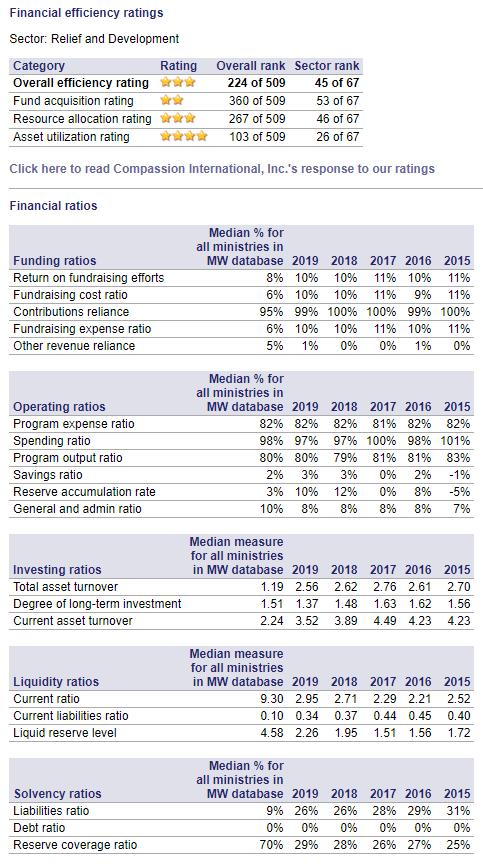

The financial analysis of nonprofits remains the main (and often the only) metric used by rating and accreditation agencies. Compassion makes an appeal to some of them.

As an example, Compassion in the Netherlands has appealed to the Charity Navigator evaluation (Charity Navigator does not evaluate the Dutch Compassion office), and the CBF accreditation agency, making the claim that this agency evaluates Compassion to see if it uses donations in a responsible way (a dubious assertion). The evaluation of the International office of Compassion by Charity Navigator is used by fund raising offices in other countries to promote their own work: see an example below (this promotion was removed from the web site after Charity Navigator reduced their evaluation in subsequent years). Evaluation of a local office cannot be in isolation of an appraisal of the entire organization to be meaningful (see: about the charity chain above). A seal signifying government recognition of the charity does not reflect on the relative impact of that charity; and accreditation seals, which come at substantial costs do not indicate a relative evaluation of a charity ($ 16,480 for Compassion USA to use the ECFA seal; $11,800 for the CBF seal in the Netherlands, etc.; see as an example the Ministry Watch's review of the ECFA). Charity Audits , as well, do not give a clean bill of health or a relative assessment of a charity.

In order to rate a charity properly, it is paramount to define the terms used; what is a charity, a gift, a grant, fund raising costs, overhead, project costs, christian, poor, etc.? Even a word like 'we' needs to be defined when it is claimed that 'we' help so many millions of people, etc. Often the use of these terms are understood differently by the charities themselves and potential donors. For that reason, and for clarity, it is necessary to dispel with some common myths about charities, their work and their values. In so doing, we define the terms that we use in accordance with common usage.

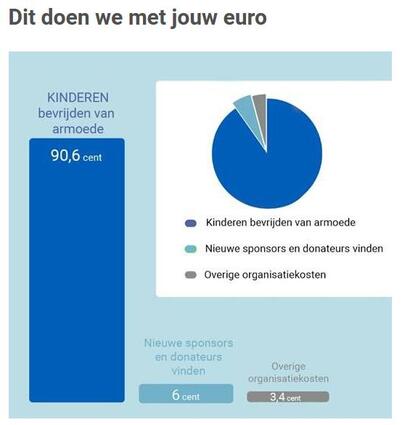

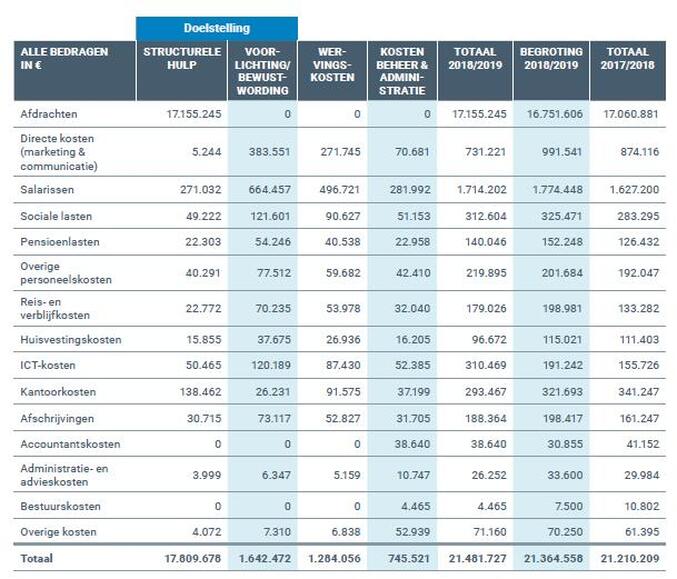

For example, what does Compassion mean with the words "Freeing children from poverty in Jesus' name"? To illustrate this, we look to Compassion in the Netherlands. In their pie diagram, they claim that 90.6% of your donation goes to freeing children from poverty (only 9.4% is used for fund raising and administration costs). They explain what this means in the following spreadsheet in the columns under the blue heading 'doelstelling' (purpose, or project costs). 'Freeing children from poverty in Jesus' name' is here defined as 54.6%% of the salaries paid to the Dutch employees, 54.7% of pension benefits, 55.0% of ICT costs, 56.0% of office costs, etc. Included in the 'purpose costs' is the grant to Compassion Int. in the USA, which would only be enough to cover about 10% of costs for salaries of those working in the Colorado office. 0% of donations are sent directly to field offices, the churches, or the children in poverty. It is unlikely that an average person taking a quick glans at the pie diagram would come to the conclusion that 'Freeing Children from Poverty in Jesus' name' has this meaning.

Most of the Compassion subsidiaries, and most other nonprofits have a broader understanding of 'project costs' then what it is generally taken to mean by the general populace. This implies that what is meant by administration costs and fundraising costs has a much broader meaning for the charity than it does for the average person. The majority of costs made by Compassion (NL) for ICT projects, office costs, salaries, social benefits, pensions, etc., as is the case in the spreadsheet below, are not administration or fundraising costs.

Most of the Compassion subsidiaries, and most other nonprofits have a broader understanding of 'project costs' then what it is generally taken to mean by the general populace. This implies that what is meant by administration costs and fundraising costs has a much broader meaning for the charity than it does for the average person. The majority of costs made by Compassion (NL) for ICT projects, office costs, salaries, social benefits, pensions, etc., as is the case in the spreadsheet below, are not administration or fundraising costs.

It is of significance that ARK AID explain why they do not use the prevalent methods of financials evaluations used by other evaluators. These include:

(a) fundraising ratios

(b) administration cost ratios and salaries

(c) asset ratios

(d) transparency about finances

(a) fundraising ratios

(b) administration cost ratios and salaries

(c) asset ratios

(d) transparency about finances

(a) Fundraising cost ratios:

The impropriety of using fundraising costs as a legitimization of nonprofit propriety.

Virtually all nonprofits, all charity rating organizations, and all charity accreditation agencies use as one of their foremost criteria of assessment and evaluation the factor of fundraising cost ratios. The lower the fundraising costs compared to the total funds raised, the higher the assessment. This ratio is most often displayed by way of a slice in a pie diagram. A potential benefactor, at a glance, is made to understand that a small slice of the pie, as compared to the projects slice, implies that only a very small portion of a gift is used for overhead. The implication then is: this must be a very good charity.

But this kind of appraisal, together with the visual portrayal in a pie diagram, we believe to be fundamentally unfounded and often purposefully misleading. This is evidenced by the following:

1. 'Fundraising costs', as the term is used by the various organizations, means almost everything; and therefore nothing. Excluded from the calculation of the costs is, very often, everything that is normally associated with fund raising costs, as for example advocacy costs (for the need to give to the charity), education costs (about the needs of the poor and the need to give to the charity: see the second column in the above spreadsheet), even administration costs and CEO salaries, or an unexplained portion thereof, and so on, all of which are then attributed to 'project costs' and not to 'fundraising costs'. After all, it is argued, project costs are all those costs which have to do with realization of the project, which, of course, it is claimed, would involve fund raising or administration costs (most often in an unexplained way), otherwise the project could not be realized. With this broad definition of 'project costs' it could easily be argued that 100% of donations are used for project costs. But nobody would believe that, and therefore the pretense of a small overhead.

2. Fundraising costs made by call centers, banks and gift transfer agencies that charge for services, and other charities that pass on donations and grants to the nonprofit being evaluated, all of which have already deducted a portion of the original donation, are generally not included in the calculation of the fundraising costs of the nonprofit under investigation. When fundraising costs are calculated on the basis of gifts and grants received by the nonprofit, and not on the basis of gifts given by the donor, then any claim about the worth of a charity on the basis of fund raising costs is meaningless.

3. When grants are received from governments, churches, endowments, other NGO's, etc., for which no, or minimal costs were made to attain, then the inclusion of these grants for the ratio calculation is misleading. Including monies extracted from assets or derived from the investment of assets (whether from interest on savings, stock market gains, or similar) in the ratio calculations is equally misleading.

4. Statistics show that spending to do professional fundraising is effective and can be very profitable. But statistics reveal as well that the overall amount given by the general populace on the basis of per capita income has remained stable for decades. This means that success in fundraising for the one charity, inevitably results in a decrease of funding for other nonprofits. 83% of all funds raised in the USA goes to only 1% of the nonprofits (in other countries the numbers are probably not much different). Another way to say this is that 99% of nonprofits receive 83% less funding out of the total amount given because of the fund raising success of the 1%. Only when it is proven that the successful fund raising nonprofit is better (not in fund raising but in doing good, dollar for dollar) could it be established that a good fundraising ratio would possibly be indicative of the worth of the nonprofit. If the opposite is true, a good fund raising ratio would be indicative inversely of how undesirable it would be to give to that nonprofit. Just another reason why fundraising ratios in themselves are meaningless.

5. Optimal fundraising ratios based on 3rd party grant making to a nonprofit invariably implies that the nonprofit is often indebted to the grant maker in the sense that the conditions for project realization are for an important part dictated by the grant maker. Government grants, for example, might be given under the condition that only certain countries or project types are allowed, or that a demand is made for the absence of religious activities or otherwise. Positive fund raising ratios may in this case be indicative of other adverse tendencies and point to restrictions for the nonprofit to do good.

6. It is often the prospect of fundraising success that is the determining factor of a nonprofit for the choice of projects and locations. And that success is in turn often determined by the amount of media attention given to a country, a catastrophe, or other need. Locations where the need is perhaps much greater, and projects that produce a greater impact but less revenue, are then not addressed, all of this due to an unhealthy focus on fundraising. The desire of fundraising success often stands at odds with the possibility of doing a maximum amount of good; another reason why fundraising ratios are not indicative of nonprofit propriety.

The impropriety of using fundraising costs as a legitimization of nonprofit propriety.

Virtually all nonprofits, all charity rating organizations, and all charity accreditation agencies use as one of their foremost criteria of assessment and evaluation the factor of fundraising cost ratios. The lower the fundraising costs compared to the total funds raised, the higher the assessment. This ratio is most often displayed by way of a slice in a pie diagram. A potential benefactor, at a glance, is made to understand that a small slice of the pie, as compared to the projects slice, implies that only a very small portion of a gift is used for overhead. The implication then is: this must be a very good charity.

But this kind of appraisal, together with the visual portrayal in a pie diagram, we believe to be fundamentally unfounded and often purposefully misleading. This is evidenced by the following:

1. 'Fundraising costs', as the term is used by the various organizations, means almost everything; and therefore nothing. Excluded from the calculation of the costs is, very often, everything that is normally associated with fund raising costs, as for example advocacy costs (for the need to give to the charity), education costs (about the needs of the poor and the need to give to the charity: see the second column in the above spreadsheet), even administration costs and CEO salaries, or an unexplained portion thereof, and so on, all of which are then attributed to 'project costs' and not to 'fundraising costs'. After all, it is argued, project costs are all those costs which have to do with realization of the project, which, of course, it is claimed, would involve fund raising or administration costs (most often in an unexplained way), otherwise the project could not be realized. With this broad definition of 'project costs' it could easily be argued that 100% of donations are used for project costs. But nobody would believe that, and therefore the pretense of a small overhead.

2. Fundraising costs made by call centers, banks and gift transfer agencies that charge for services, and other charities that pass on donations and grants to the nonprofit being evaluated, all of which have already deducted a portion of the original donation, are generally not included in the calculation of the fundraising costs of the nonprofit under investigation. When fundraising costs are calculated on the basis of gifts and grants received by the nonprofit, and not on the basis of gifts given by the donor, then any claim about the worth of a charity on the basis of fund raising costs is meaningless.

3. When grants are received from governments, churches, endowments, other NGO's, etc., for which no, or minimal costs were made to attain, then the inclusion of these grants for the ratio calculation is misleading. Including monies extracted from assets or derived from the investment of assets (whether from interest on savings, stock market gains, or similar) in the ratio calculations is equally misleading.

4. Statistics show that spending to do professional fundraising is effective and can be very profitable. But statistics reveal as well that the overall amount given by the general populace on the basis of per capita income has remained stable for decades. This means that success in fundraising for the one charity, inevitably results in a decrease of funding for other nonprofits. 83% of all funds raised in the USA goes to only 1% of the nonprofits (in other countries the numbers are probably not much different). Another way to say this is that 99% of nonprofits receive 83% less funding out of the total amount given because of the fund raising success of the 1%. Only when it is proven that the successful fund raising nonprofit is better (not in fund raising but in doing good, dollar for dollar) could it be established that a good fundraising ratio would possibly be indicative of the worth of the nonprofit. If the opposite is true, a good fund raising ratio would be indicative inversely of how undesirable it would be to give to that nonprofit. Just another reason why fundraising ratios in themselves are meaningless.

5. Optimal fundraising ratios based on 3rd party grant making to a nonprofit invariably implies that the nonprofit is often indebted to the grant maker in the sense that the conditions for project realization are for an important part dictated by the grant maker. Government grants, for example, might be given under the condition that only certain countries or project types are allowed, or that a demand is made for the absence of religious activities or otherwise. Positive fund raising ratios may in this case be indicative of other adverse tendencies and point to restrictions for the nonprofit to do good.

6. It is often the prospect of fundraising success that is the determining factor of a nonprofit for the choice of projects and locations. And that success is in turn often determined by the amount of media attention given to a country, a catastrophe, or other need. Locations where the need is perhaps much greater, and projects that produce a greater impact but less revenue, are then not addressed, all of this due to an unhealthy focus on fundraising. The desire of fundraising success often stands at odds with the possibility of doing a maximum amount of good; another reason why fundraising ratios are not indicative of nonprofit propriety.

(b) Administration cost ratios

The various administration costs (however that is defined) of the corporate body of charities is less relevant when one's concern is exclusively that of the output as it relates to the input. Of course there will be less output by high administration costs.

(i) Salaries

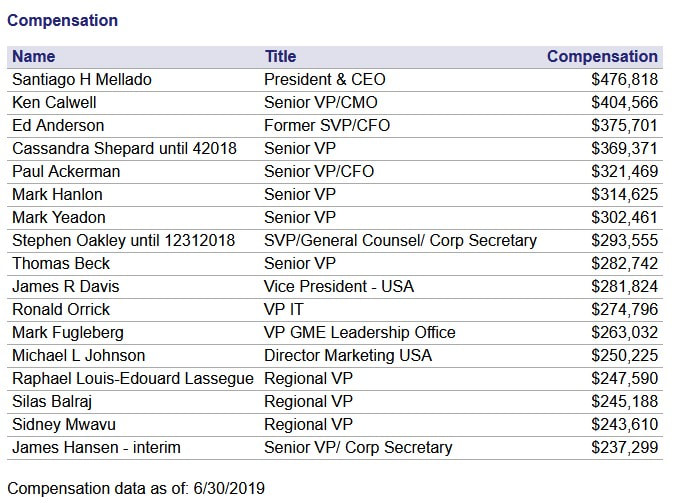

An easy metric to relate to are the compensations paid to those working for a charity, especially the executives. This is for many the single most relevant factor in the decision to give to a charity. ARK AID does not use this as a metric of evaluation.

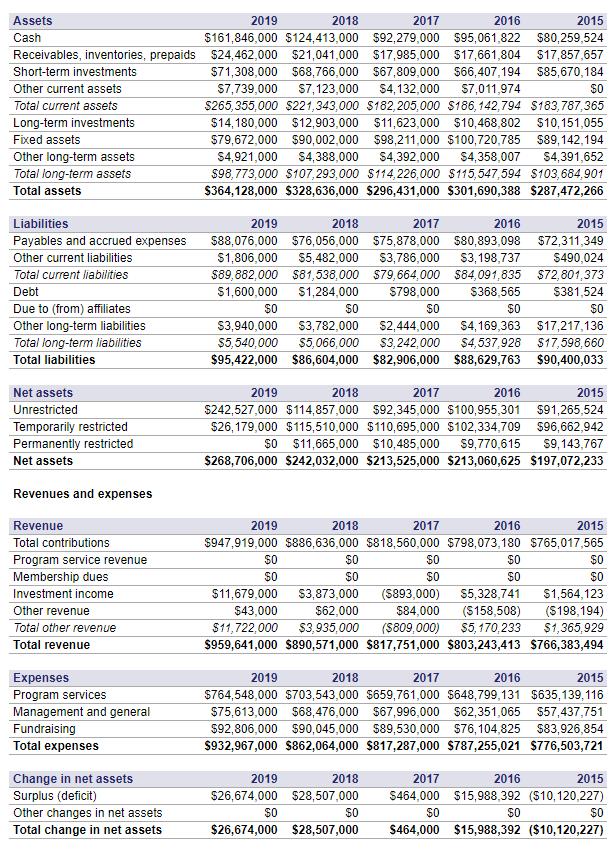

ARK AID does not use compensation calculations as a metric of measurement. The question if the compensation of Mr. Mellado, CEO of Compassion USA, being $476,818.00 is too much, is not considered. It would be more relevant to know the total compensation (for Compassion USA: $ 167,763,104), or the average compensation of all employees of a charity: for Compassion USA, that is $140,500.00 whereas the average compensation for Samaritans Purse employees is $48,500.00 while their CEO, Franklin Graham has a salary in excess of a million dollars (from two charities). The relevance and necessity of these numbers, as is that of the numbers of employees (Compassion USA, just one link in the charity-chain, has 1,196) is also not part of the ARK AID revenue metric measurement, except in an indirect way: more compensation equals less output of the input, which is the only aspect of the money flow that ARK AID considers. For similar reasons it is not necessary to delve into questions such as other social benefits accompanying compensations, compensations of external contractors, etc.

(ii) Other administration costs

As is the case with salaries, it becomes less relevant to assess IT costs, building costs, contracting costs, etc., etc. All of these reduce the output of gifts which is the primary mode of measurement by ARK AID when it uses the revenue metric.

(c) Asset ratios

The ratio between net assets and total revenue is often chosen as an important metric to asses charities. ARK AID does not include this aspect for appraisal because they regard this as a part of the 'input minus output' revenue metric. The more input which goes to assets, the less output. And well managed assets because of good investments will increase the output when used for that cause. In this way asset ratios are indirectly a part of the the ARK AID revenue metric.

Asset ratios are included in the charity listing spreadsheet so that by disproportionate ratios potential donors may regard this as a red flag (see for this: AAA.charity: the second column) .

Asset ratios are included in the charity listing spreadsheet so that by disproportionate ratios potential donors may regard this as a red flag (see for this: AAA.charity: the second column) .

(d) Transparency

Efficient appraisal of each metric is dependent upon the transparency about these segments as it is supplied by the charity, especially as it pertains to the 'output-charity'. When transparency is deficient, an educated guess is made in which the benefit of the doubt tends to the negative side, the thought being, that perhaps someone is hiding something, and, better safe than sorry, which is the same as the giving of a negative evaluation because of a lack of transparency. For this reason transparency, as such, is not included as one of the segments of ARK AID appraisal.

Reviews as a means of evaluation

|

Reviews from Ted Sherwood (Business by the Book) about Compassion Australia: in 2019

about: Charity Audits |

Evaluations given by organizations

|

Charity Navigator evaluates Compassion

Evaluation of a local office cannot be in isolation of an appraisal of the entire organization to be meaningful (see: the charity chain above). See: more on the Charity Navigator methodology and the financial scores conversion table. |

|

More about Ministry Watch and Wall Watchers; the Christian ranking and rating agency: the philosophy and methodology. Compassion does not appeal to this agency (because it only gives 3 out of 5 stars? See: explanation of the 5 stars rating system)

|

How then does ARK AID calculate the Revenue metric;

input minus output

input minus output

The ARK AID revenue metric calculation is only interested in one factor: how much of one's input ends up as output. Knowing this (next to the Religious, the Recipient, and the Results metrics), is the most relevant issue that should concern someone giving to a nonprofit. Because charities rarely supply this information, a calculation must be made. To make this calculation, it is necessary to know the following facts:

1. what is the nature of the charity as corporate body or as charity-chain?

2. what is the source, nature, and amount of funding by each link in the chain?

3. what is the destination and amount of grants given by each link in the chain?

1. what is the nature of the charity as corporate body or as charity-chain?

2. what is the source, nature, and amount of funding by each link in the chain?

3. what is the destination and amount of grants given by each link in the chain?

Under construction Coming soon

To follow the money flow from input to output, the following is kept in view:

1. What is the source?

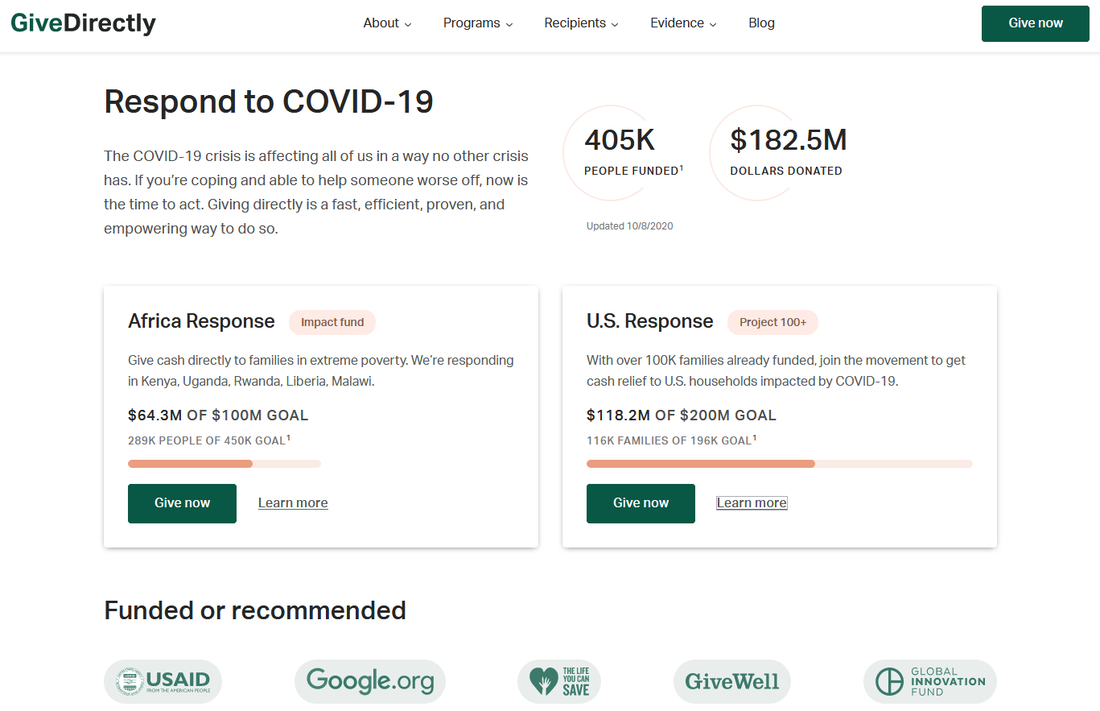

a. If it a joint action source, then we assume that the donor only wants to give a portion of his gift to the charity under consideration. See example below in which a gift to Compassion means two thirds of the gift goes to other charities

1. What is the source?

a. If it a joint action source, then we assume that the donor only wants to give a portion of his gift to the charity under consideration. See example below in which a gift to Compassion means two thirds of the gift goes to other charities

|

b. We hold that gift-matching incomes do not influence the input/output balance.

|

c. We hold that designated gifts for a special project do not effect the input/output ratio.

|

d. Input to Compassion from 3rd party sources and other charities is calculated according to the input to those sources, and not the input (the grants) to Compassion. An example:

|

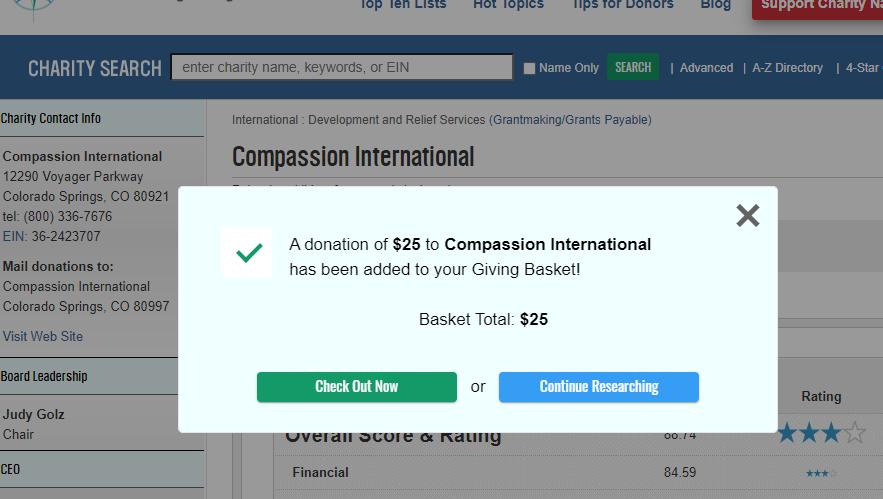

About remittances and platform costs:

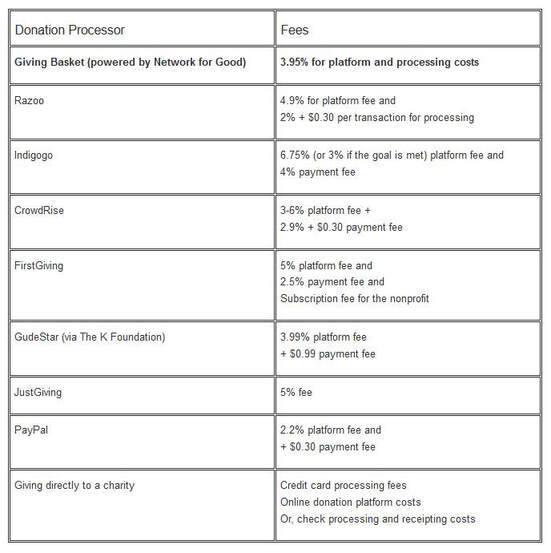

Someone goes to Charity Navigator to check on Compassion and then decides to give. Unless one presses the 'Continue Researching' button, and does some research, it will not be apparent that the gift is going to a different charity which deducts a certain percentage from your gift before sending the remainder to Compassion. In this case 3.95% (which is made to look as if it is far less than 4%). Deductions can be as high as 90% of your gift if it goes to a call-center-charity. |

In this case, a gift to Compassion via Charity Navigator via the charity Network for Good, means that the input/output ratio is reduced by 4%.

In the case that there is no transparency about remittance costs in the same currency area we assume that the percentage is 5%.

In the case that there is no transparency about the total amount of funding via a remittance 'charity' we assume that the amount is 50% of total annual revenue.

In the case that there is no transparency and remittances (grants) are sent to other countries using different currencies, we assume the percentage is 7%.

In the case that there is no transparency and gifts go by way of a call-center, we assume that 50% of total annual revenue comes by way of the call center and that 50% of gifts are costs for the call-center. In that case 50% of total revenue reduced by 50% costs, means that the input/output ratio of such a charity is reduced by 25%.

In the case that there is no transparency about remittance costs in the same currency area we assume that the percentage is 5%.

In the case that there is no transparency about the total amount of funding via a remittance 'charity' we assume that the amount is 50% of total annual revenue.

In the case that there is no transparency and remittances (grants) are sent to other countries using different currencies, we assume the percentage is 7%.

In the case that there is no transparency and gifts go by way of a call-center, we assume that 50% of total annual revenue comes by way of the call center and that 50% of gifts are costs for the call-center. In that case 50% of total revenue reduced by 50% costs, means that the input/output ratio of such a charity is reduced by 25%.

e. Input to nonprofits from government sources are frequently conditioned on a high output. Without transparency about this factor we estimate that 75% of government grants end up as output. An example: a charity has a total input of $200,000. 50% is from the government and 50% from donors. $120,000 is calculated to be total output. 75% of $100,000 is $75,000 which implies $45,000 comes from non-governmental donors to add up to $120,000 output. In this case the revenue metric for this charity is calculated as 45%, and not 60%, because only the input/output efficiency of the donated money, apart from government sources, is of concern.

Coming soon-Under construction

The input/output calculation is done by way of a spreadsheet showing 5 input possibilities which pass along 7 links of the chain.

|

Explanation of money-flow table (the Revenue metric)

Input 1=gifts 2=gifts in kind (-50% of estimated value by no transparency) 3=3rd party (or charity) grants (-50% by no transparency) 4=government grants (+75% of grant as Output) 5=average of the input and output ratio of a selection of randomly chosen affiliates extrapolated to be applicable to the other affiliates. In the case of Compassion, which has 15 fund raising charity affiliates (most of which carry the name Compassion), we make a random choice of 4. |

The Charity Chain

C1=currency transfer agencies (-4% national) C2=exchange rate and currency transfer bank costs (-6% inter-national) C3=fund raising agencies including call centers (-50% by no transparency) C4=regional input (fund raising) charities (-50% by no transparency) C5=international charities C6=regional coordination charities C7=regional output charities (-50% by no transparency) the Input/Output=Revenue metric grade is in % |

2. Religious

This metric provides an appraisal of the identity (50 points max) and integrity (50 points max) of a charity. This applies foremost to the 'output charity' and secondarily to the 'control charity', 'fund raising charity' and other organizations in the 'charity-chain'.

(a) Identity

Inquiry is made about the meaning of the professed 'Christian' identity, of explicit or implicit values, a statement of faith, etc. Statistics show that in many countries charities with the claim of being 'Christian' have an advantage at fund raising success and could for that reason identify themselves as 'Christian'. But, because the word 'Christian' has taken on such a diversity of meanings, some of which are the exact opposite of what ARK AID considers to be the historical orthodox meaning (as is the case with much of the 'prosperity gospel'), it becomes necessary to include this as a metric of evaluation. Because the ARK AID appraisal is interactive, this method of evaluation can be adopted by others with a different perspective on identity.

Compassion does not provide a statement of faith (=0 points). The 'output charities' (also called 'partners'), for the most part, consist of a variety of evangelical church related organizations (=25 points).

Compassion does not provide a statement of faith (=0 points). The 'output charities' (also called 'partners'), for the most part, consist of a variety of evangelical church related organizations (=25 points).

(b) Integrity

Questions are asked as to the truth factor of claims about results, costs, fund raising methodology, donation anchors, investment policy, etc. Integrity measurement of the 'output charities' is a virtual impossibility, and therefore this is done for the fund raising charities, and especially for the control charity (or international office) which, it is assumed, controls the output charity. An example of deception by Compassion is given in the above claim by the Dutch division of Compassion that 90.6% of gifts are used for "Freeing children from poverty in Jesus' name". An analysis by ARK AID of the integrity metrics give Compassion 15 points. As is the case with the identity metric, it is possible by disagreement about this metric, because of the interactive possibilities of appraisal, to give an alternative evaluation.

25 points out of 50, plus 15 points out of 50 gives Compassion a score of 40% for the Religious metric.

3. Recipient

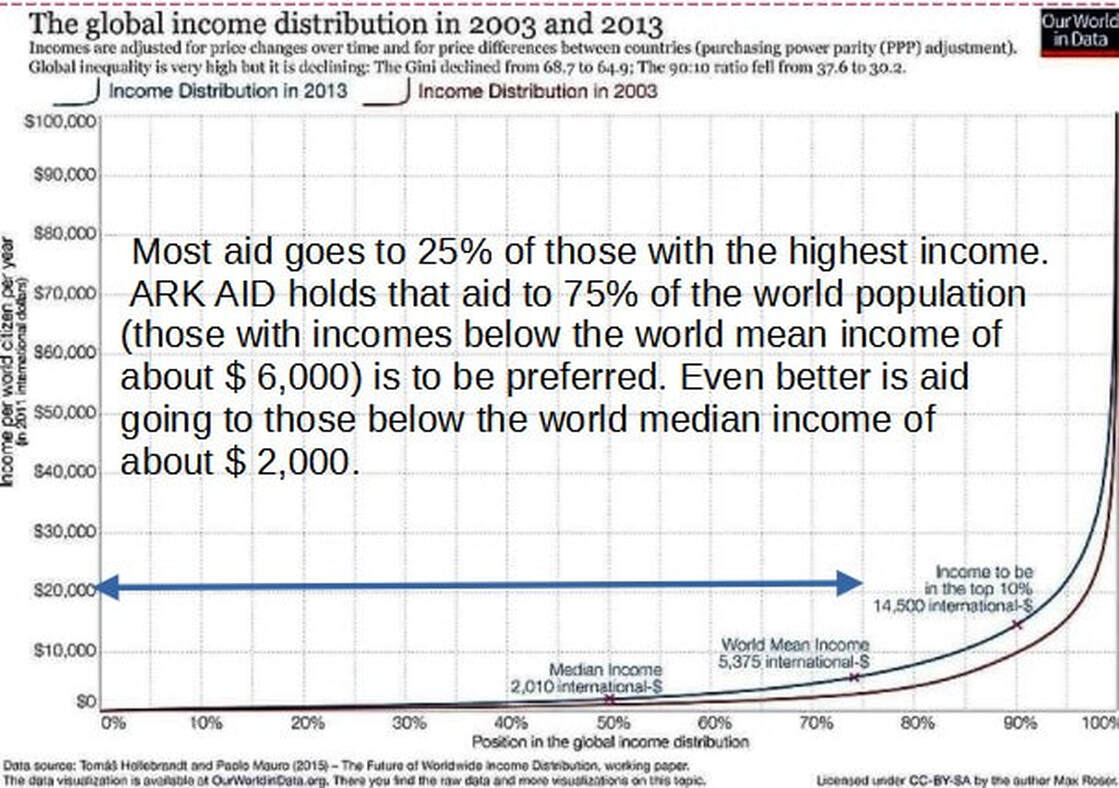

ARK AID holds that poverty assistance should be directed to the recipient most in need.

There is a massive global income and economic inequality (see the poverty gap data and see the economic inequality data)

The simple logic is that all aid directed to the relatively rich does not go to the extremely poor (see the global extreme poverty data).

In many cases this means that helping the few implies not helping the many.

There is a massive global income and economic inequality (see the poverty gap data and see the economic inequality data)

The simple logic is that all aid directed to the relatively rich does not go to the extremely poor (see the global extreme poverty data).

In many cases this means that helping the few implies not helping the many.

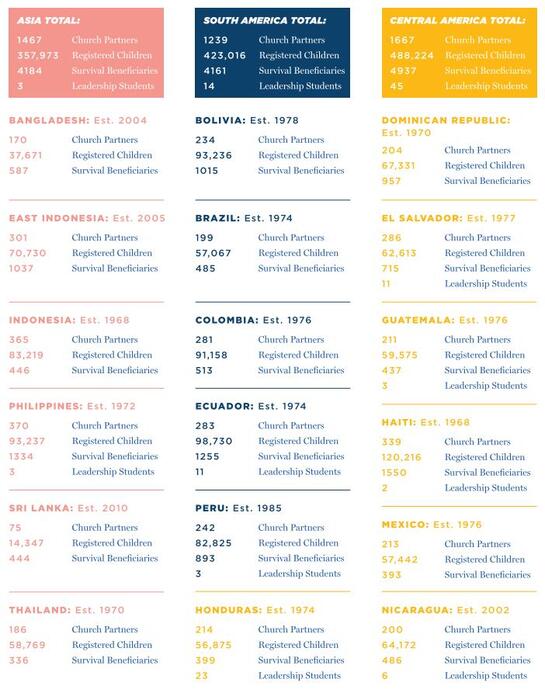

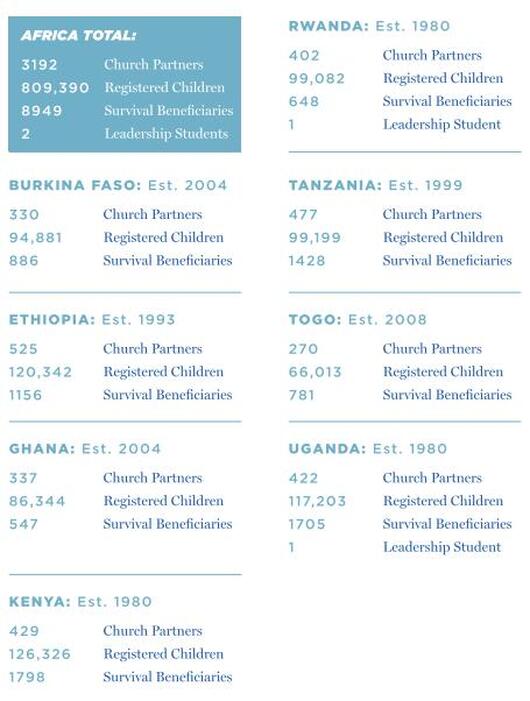

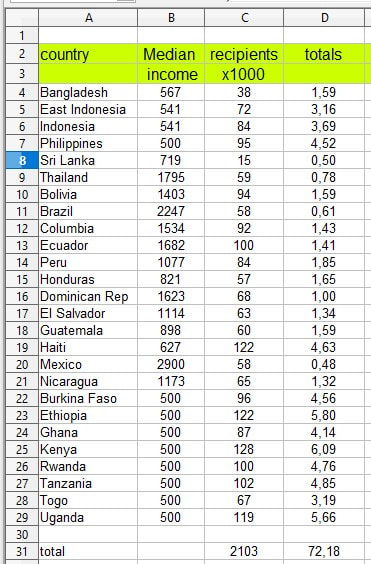

In the case that charities do not supply information about the median income of the recipients whom they serve, ARK AID uses the median income of the country in which the Charity gives aid for the calculation of the 'recipient' metric. And in the case that only a broad region is indicated, the median income of that region is used in the calculation. Calculations are on the basis of the latest available data for countries and regions. (see PDF of world median income)

The world average or mean income is higher than the median (mid point) income (see average income data). Also see why the median is used for the recipient metric calculation.

Below is an example of the calculation of the Recipient metric as it applies to Compassion:

|

Calculation per country = (median world per capita income / median per capita income of country (in ppp) x 25) x (number of recipients in country / total number of recipients)

Where country median per capita income is less than $500, calculations are on the basis of $500 which gives a metric value of 100%. Country median per capita incomes of more than $6000 gives a metric evaluation of 0.0%. which accounts for 25% of the world population. An example: $2000 (world median per capita income) / $627 (Haiti median per capita income) * 25 = 80% metric evaluation; The calculation takes into account the relative number of participants in a country: 122,000 (recipients in Haiti) / 2,103,000 (total number of recipients) = 0.058% of total; 0.058 * 80 = 4,63 This is similar to: 50,000 / country or region median per capita income = % metric evaluation: An example: A charity with projects located exclusively in Thailand receives for the Recipient Metric a rating of 50000/1795 = 28% If a charity makes available the per capita income of the recipients of their aid, then that information is used instead to the country per capita income. The Recipient Metric for Compassion is here calculated as 72% |

More data on international median incomes: Median Incomes

4. Results

Under construction Coming soon

This metric takes a look at those things that are indicative of the level of accomplishment that a 'output charity' would probably realize. This includes levels of professionalism, specialization, and concentration of project locations, etc. (ARK AID gives Compassion a grade of 75% for this metric). Results measurements are only indicative; we hold that a quantification of results as such, and more so of outcomes and impact, although desirable, is at its best only partially attainable. It may seem to be insufficient to only give a maximum of 15 points for results measurements. After all, this is what giving is all about, to get good results to make a maximum impact. But we hold that the variables of Revenue, Religious, and Recipient are themselves indicators of Results. Less Revenue (throughput of the gift), as an example, is indicative of the fact that Results would also be less.

Results are for a large part influenced by the nature of the aid provided. Adoption schemes, water purification and availability, health and education, mosquito nets, microfinance loans, agricultural aid, etc., etc., all differ as to impact by poverty alleviation, but are not taken into account by ARK AID appraisal. It is made possible to include this, according to personal preference, by adding an impact metric to the 'interactive charity evaluator' or by expanding the relative importance of the Results metric and changing the evaluation given by ARK AID to that metric.

Results are for a large part influenced by the nature of the aid provided. Adoption schemes, water purification and availability, health and education, mosquito nets, microfinance loans, agricultural aid, etc., etc., all differ as to impact by poverty alleviation, but are not taken into account by ARK AID appraisal. It is made possible to include this, according to personal preference, by adding an impact metric to the 'interactive charity evaluator' or by expanding the relative importance of the Results metric and changing the evaluation given by ARK AID to that metric.

|

|

Although Compassion has a diversity of aid types, the main one is aid for children in boarding schools. ARK AID does not include the type of aid in it's metric calculations. But it is advised that the donor take this important factor into consideration when choosing a nonprofit. The video to the left shows some hesitations to many boarding school 'adoption' approaches. The interactive appraisal spreadsheet allows for the addition of an extra metric which could be used to include the type of aid as an indicator of effective altruism.

More on child sponsoring. |

Summery of the use of the AAA Algorithm:

R1+R2+R3+R4=comparative appraisal

Same as: (input/output*relative importance)+(identity+integrity*relative importance)+(median world per capita income/country median or region per capita income*25*relative importance)+(results*relative importance)=appraisal

Same as: (in/out*50%)+(id*10%+int*10%)+(2000/cmed*25*15%)+(res*15%)=appraisal

Same as: (in/out*0.5)+(id*0.1+int*0.1)+(50000/cmed*0.15)+(res*0.15)=appraisal (cmed is minimum 500 and maximum 6000)

R1+R2+R3+R4=comparative appraisal

Same as: (input/output*relative importance)+(identity+integrity*relative importance)+(median world per capita income/country median or region per capita income*25*relative importance)+(results*relative importance)=appraisal

Same as: (in/out*50%)+(id*10%+int*10%)+(2000/cmed*25*15%)+(res*15%)=appraisal

Same as: (in/out*0.5)+(id*0.1+int*0.1)+(50000/cmed*0.15)+(res*0.15)=appraisal (cmed is minimum 500 and maximum 6000)